All Categories

Featured

Table of Contents

- – Life Insurance Planning Santa Ana, CA

- – Harmony SoCal Insurance Services

- – Family Plan Health Insurance Santa Ana, CA

- – Bcbs Health Insurance Plans Santa Ana, CA

- – Best Health Insurance Plans Near Me Santa Ana...

- – Blue Cross Blue Shield Health Insurance Plans...

- – Health Insurance Plans For Family Santa Ana, CA

- – Family Health Insurance Plans Santa Ana, CA

- – Life Insurance Family Plan Santa Ana, CA

- – Seniors Funeral Insurance Santa Ana, CA

- – Family Health Insurance Plan Santa Ana, CA

- – Family Plan Health Insurance Santa Ana, CA

- – Best Health Insurance Plans Near Me Santa An...

- – Harmony SoCal Insurance Services

Life Insurance Planning Santa Ana, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

https://maps.google.com/maps?ll=33.823884,-117.830838&z=16&t=h&hl=en&gl=US&mapclient=embed&cid=276141583131225364

Questions? We enjoy to help you every action of the method.

Due to the fact that there are several different kinds of wellness strategies, you ought to be sure to search for the one that fits your demands. Extensive wellness insurance coverage offers benefits for a broad range of health care solutions. These health insurance plan supply a thorough list of health and wellness benefits, may limit your expenses if you obtain solutions from one of the suppliers in the plan's network, and generally need co-payments and deductibles.

Family Plan Health Insurance Santa Ana, CA

You are only covered if you get your treatment from HMO's network of companies (except in an instance of emergency). With most HMO plans you pay a copayment for every covered solution. For instance, you pay $30 for an office visit and the HMO pays the rest of the price.

These plans have a network of favored companies that you can utilize, but they additionally cover solutions for out-of-network suppliers. PPP's will certainly pay more of the expense if you make use of a supplier that is in the network. Example: After copays and deductibles, the plan pays 100% of a service for a network carrier yet 80% for an out-of-network (OON) company.

Significant clinical plans usually cover medical facility and clinical costs for a crash or illness. Example: the strategy pays 80% of your hospital keep and you pay the other 20%.

Whether you pick a significant medical plan, an HMO or a PPP, your plan will most likely have some "cost-sharing" features. This implies that you share the price of care by paying part of the cost for each service and the insurer pays the rest. Choose a plan that functions ideal with the type of medical insurance you assume you will use.

Bcbs Health Insurance Plans Santa Ana, CA

Example, you pay $30 for a workplace check out and the plan pays the rest. A deductible is the quantity you pay prior to the plan begins to pay for a lot of covered solutions.

You pay a $2,500 deductible towards your healthcare services yearly before the strategy pays any type of Coinsurance is a percent of the enabled cost that you pay for a protected solution advantages. Coinsurance is a percent of the enabled cost that you pay for a protected service. You pay 20% of the price of a covered office go to and the plan pays the rest.

Best Health Insurance Plans Near Me Santa Ana, CA

The plan might allow just 10 brows through to a chiropractic specialist. The plan might omit (not pay for) cosmetic surgical procedure, and you will certainly pay for the entire price of service.

There are several means that you can buy a health insurance in Massachusetts. Many individuals get their wellness plan with their place of work. For individuals that can not do this, there are a number of other ways to get a health plan. In Massachusetts over 70% of all companies provide health and wellness insurance coverage as a benefit to their workers.

Blue Cross Blue Shield Health Insurance Plans Santa Ana, CA

You can pick the health insurance that is ideal for you from the choices provided. If you are enrolled as a pupil in a Massachusetts university or college, you can buy a wellness plan with your school. This SHIP id made for trainees and is only readily available while you are registered.

And the business can not transform you down if you have a health and wellness problem. Sometimes the company will certainly direct you to buy their health insurance via an intermediary. An intermediary is a firm that deals with the enrollment and premiums. If you satisfy specific earnings needs, you may be qualified for MassHealth.

Health Insurance Plans For Family Santa Ana, CA

You can discover more at or call 1-800-841-2900 If you do not help a company that pays at the very least 33% of your health strategy premium, you might be able to purchase a health insurance plan from the Connector. These are plans offered by Massachusetts HMOs that the Adapter has picked to have great worth.

The state and federal government provide reduced expense health protection for sure individuals via public wellness programs. This includes the Indian Health Solutions, Peace Corps, CommonHealth, HealthyStart and various other programs. You might call 1-800-841-2900 to read more concerning these programs. When picking a health strategy, it is crucial to think about the differences between your options.

Searching for health insurance coverage can be frustrating, yet keep in mind, if the plan sounds also excellent to be real, it possibly is. Do deny a discount rate strategy as an option to health and wellness strategy coverage. Discount rate plans charge a regular monthly fee in exchange for access to healthcare services at a decreased fee.

There are not details customer protections that apply to these plans. They may not guarantee any payments, and they do not necessarily pay costs for the exact same kinds of services that health and wellness insurance covers.

Family Health Insurance Plans Santa Ana, CA

That way you can see in breakthrough if the plan is ideal for you and your family members. Ask what advantages the strategy does and does not cover, what benefits have limitations; ask whether the strategy covers your prescription drugs; ask where you can see a checklist of the healthcare companies in the plan's network.

High out-of-pocket expenses can soon eliminate the savings of reduced monthly premiums. You need to ask what is the monthly costs you would spend for the plan, what out-of-pocket costs will you have and whether there is an optimum, and what is the insurance deductible. Do not be tricked by fake health plans offering on the net or through unwanted faxes or telephone call.

Evaluation any website thoroughly and try to find disclaimers such as "this is not insurance policy" or "not available in Massachusetts." Beware of advertising and marketing that does not provide the specific name and address of the insurance provider providing the health insurance. If the caller hesitates to supply the precise name of the company, his/her name, where the firm lies, or whether the company is certified, or if they are an accredited insurance policy agent, you need to just hang up.

Life Insurance Family Plan Santa Ana, CA

You do not ever require to give economic information so as to get a quote. Be cautious of high stress sales techniques that tell you a low regular monthly cost is a minimal time deal and will end in a day or 2. There is no such point as a restricted time deal or "unique" in health insurance.

When you do discover a health insurance plan that resembles it satisfies your requirements, examine the Department of Insurance policy web site or phone call to learn if the business is licensed to sell that kind of insurance policy in Massachusetts before you commit to getting the item. Be cautious not to give out individual details or make a settlement in reaction to an unwanted fax or without inspecting it out.

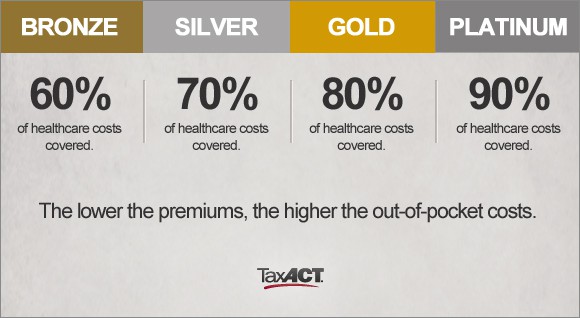

Bronze plans have the least protection, and platinum plans have the many.

Seniors Funeral Insurance Santa Ana, CA

Exactly how are the plans different? In addition, deductibles-- the quantity you pay prior to your plan pays any of your health treatment prices-- vary according to plan, typically with the least expensive carrying the highest insurance deductible.

If you see a doctor who is not in the network, you may have to pay the full costs yourself. Emergency solutions at an out-of-network healthcare facility need to be covered at in-network rates, yet non-participating medical professionals that treat you in the hospital can bill you. This is the price you pay monthly for insurance.

A copay is a level cost, such as $15, that you pay when you obtain care. Coinsurance is when you pay a portion of the fees for care, for instance, 20%. These fees differ according to your strategy and they are counted toward your insurance deductible. There are no case develops to complete.

Greater out-of-pocket prices if you see out-of-network physicians vs. in-network providersMore documentation than with other plans if you see out-of-network companies Any in the PPO's network; you can see out-of-network doctors, but you'll pay even more. This is the cost you pay every month for insurance policy. Some PPOs might have a deductible.

Family Health Insurance Plan Santa Ana, CA

A copay is a flat charge, such as $15, that you pay when you get care. Coinsurance is when you pay a percent of the fees for care, for instance, 20%. If your out-of-network medical professional bills greater than others in the area do, you might need to pay the balance after your insurance pays its share.

If you use an out-of-network supplier, you'll need to pay the carrier. You have to submit a claim to get the PPO strategy to pay you back. With an EPO, you might have: A modest amount of flexibility to choose your healthcare companies-- more than an HMO; you do not need to obtain a reference from a main treatment medical professional to see a specialist.

This is the expense you pay each month for insurance. A copay is a level fee, such as $15, that you pay when you obtain care.

Family Plan Health Insurance Santa Ana, CA

A POS strategy mixes the attributes of an HMO with a PPO. With POS plan, you may have: More freedom to choose your health treatment suppliers than you would certainly in an HMOA moderate quantity of paperwork if you see out-of-network providersA primary treatment physician who collaborates your care and that refers you to professionals You can see in-network suppliers your main treatment physician refers you to.

This is the price you pay each month for insurance coverage (Planning Life Insurance Santa Ana). Your strategy might require you to pay the quantity of a deductible prior to it covers care beyond preventive services. You may pay a greater insurance deductible if you see an out-of-network carrier. You will certainly pay either a copay, such as $15, when you get care or coinsurance, which is a percent of the fees for treatment.

Aside from precautionary care, you must pay all your prices as much as your insurance deductible when you go with medical treatment. You can utilize cash in your HSA to pay these expenses. You can establish up a Health and wellness Financial savings Account to help spend for your expenses. The maximum you can add to an HSA in 2024 is $4,150 for people and $8,300 for households.

Most likely to free of charge, expert aid getting benefits that are best for you. was produced by the Wisconsin Workplace of the Commissioner of Insurance Coverage (OCI) with the Wisconsin Department of Health And Wellness Services (DHS) and many other partners. We're all devoted to assisting every Wisconsinite get accessibility to cost effective health insurance policy.

Best Health Insurance Plans Near Me Santa Ana, CA

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: info@hsocal.com

Harmony SoCal Insurance Services

What is open registration? It's the moment each loss when you can sign up in health insurance for the following year. Many of the moment, you can just subscribe during open enrollment. A life event (like marrying, having a child, or losing other coverage) may give you a special enrollment period.

Life Insurance For Retirement Planning Santa Ana, CAFamily Plan Life Insurance Santa Ana, CA

Life Insurance Planning Santa Ana, CA

Close To Seo Marketing Company Santa Ana, CA

Find Seo Management Santa Ana, CA

Harmony SoCal Insurance Services

Table of Contents

- – Life Insurance Planning Santa Ana, CA

- – Harmony SoCal Insurance Services

- – Family Plan Health Insurance Santa Ana, CA

- – Bcbs Health Insurance Plans Santa Ana, CA

- – Best Health Insurance Plans Near Me Santa Ana...

- – Blue Cross Blue Shield Health Insurance Plans...

- – Health Insurance Plans For Family Santa Ana, CA

- – Family Health Insurance Plans Santa Ana, CA

- – Life Insurance Family Plan Santa Ana, CA

- – Seniors Funeral Insurance Santa Ana, CA

- – Family Health Insurance Plan Santa Ana, CA

- – Family Plan Health Insurance Santa Ana, CA

- – Best Health Insurance Plans Near Me Santa An...

- – Harmony SoCal Insurance Services

Latest Posts

On Demand Water Heater Sorrento Valley San Diego

Tankless Water Heater Repairs Rancho Penasquitos

La Jolla Insta Hot Water Heater

More

Latest Posts

On Demand Water Heater Sorrento Valley San Diego

Tankless Water Heater Repairs Rancho Penasquitos

La Jolla Insta Hot Water Heater